In today’s digital era, managing your own finances has become easier and more manageable with the help of budgeting apps. These apps offer a series of features to track expenses, set savings goals, and stay on top of financial vigor. Whether you are looking to save for a vacation, pay off debt, or basically gain better control over your wealth, selecting the right budgeting app can make an important difference. Here’s a complete guide to some of the best budgeting apps available:.

1. Mint

Mint is most famous and highly recommended budgeting app that offers a complete suite of tools for managing finances. It syncs with your bank accounts, credit cards, and other financial accounts to arrange for a complete outline of your expenditure and earnings. Mint Budgeting App classifies transactions automatically and delivers insights into your expenses patterns. Moreover, Mint App helps set budget goals and alerts users when they go beyond their set expenses limits.

Expert Opinion:

John Smith, Financial Advisor

“Mint App is perfect for those looking for a free, all-in-one budgeting platform. Its capability to link with numerous financial accounts and provide real-time updates makes it a top choice for budgeting students.”

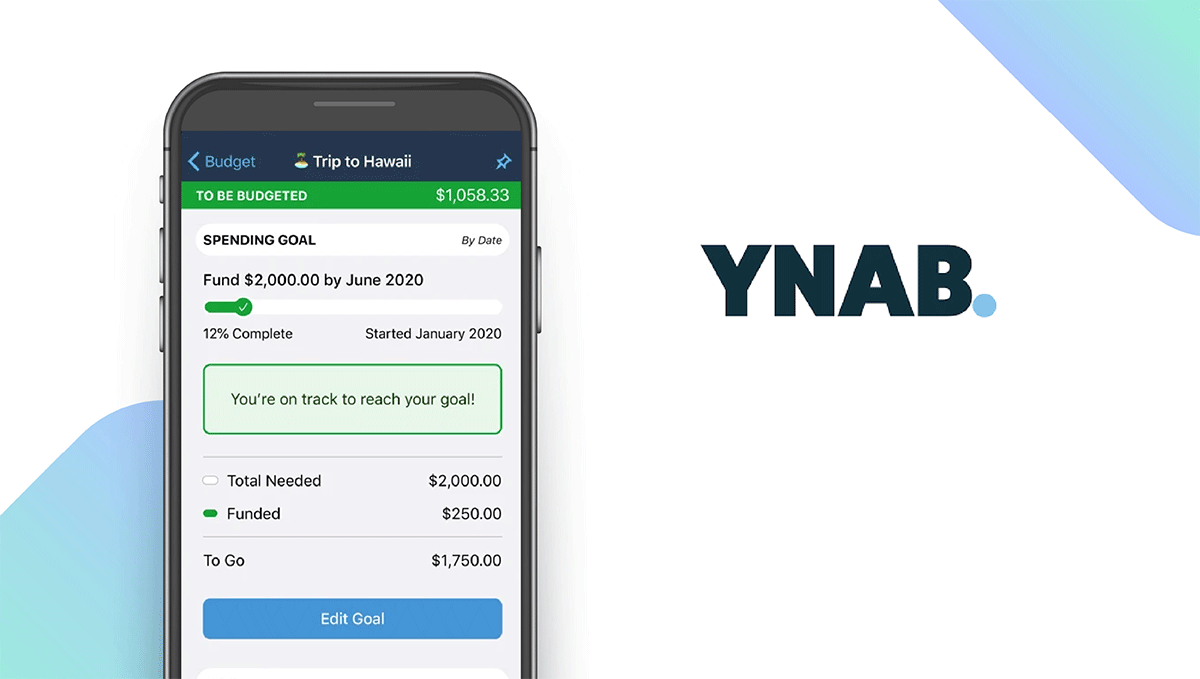

2. YNAB (You Need a Budget)

YNAB is a budgeting app based on useful budgeting and financial research. It highlights a zero-based budgeting method, where every dollar has a precise job. YNAB Budgeting App helps customers arrange savings goals, manage debt reimbursement, and plan for frequent expenses. The NYAB App also offers educational means and live workshops to help users know and improve their financial ways.

Expert Opinion:

Emily Johnson, Certified Financial Planner

“YNAB is ideal for those who want to get complete control of their expenditures and arrange savings. Its budgeting philosophy and user-friendly interface make it an influential tool for attaining financial goals.”

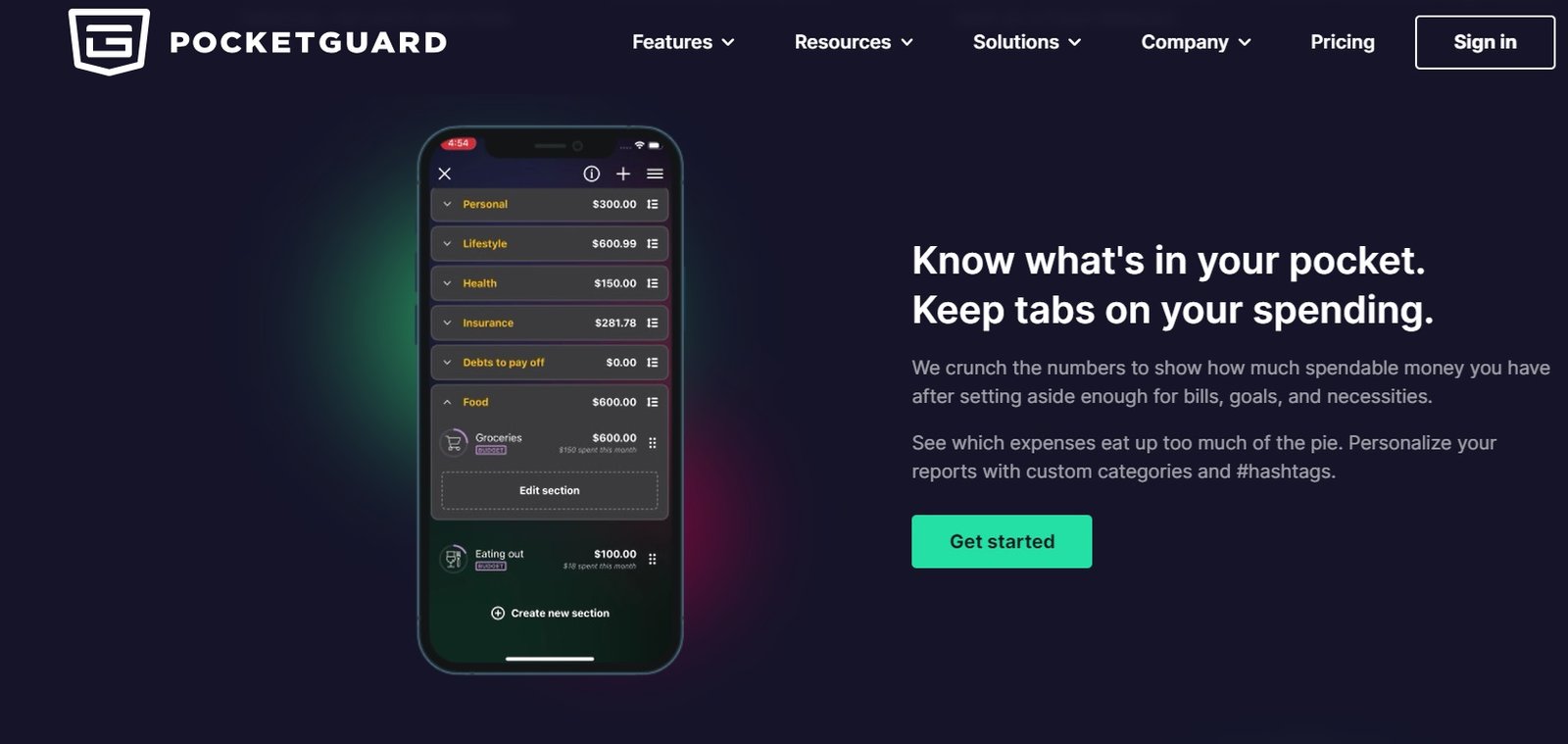

3. PocketGuard

PocketGuard streamlines budgeting by providing a strong snapshot of your financial position. The app sorts transactions, tracks bills, and features in upcoming expenditures to show how much throwaway income you have. PocketGuard’s “In My Pocket” feature helps operators understand how much cash is available for spending after accounting for bills and savings goals.

Expert Opinion:

David Lee, Personal Finance Blogger

“PocketGuard is faultless for individuals looking for a straightforward budgeting app that emphasizes day-to-day money management. Its straightforwardness and ease of use make it an excellent choice for beginners.”

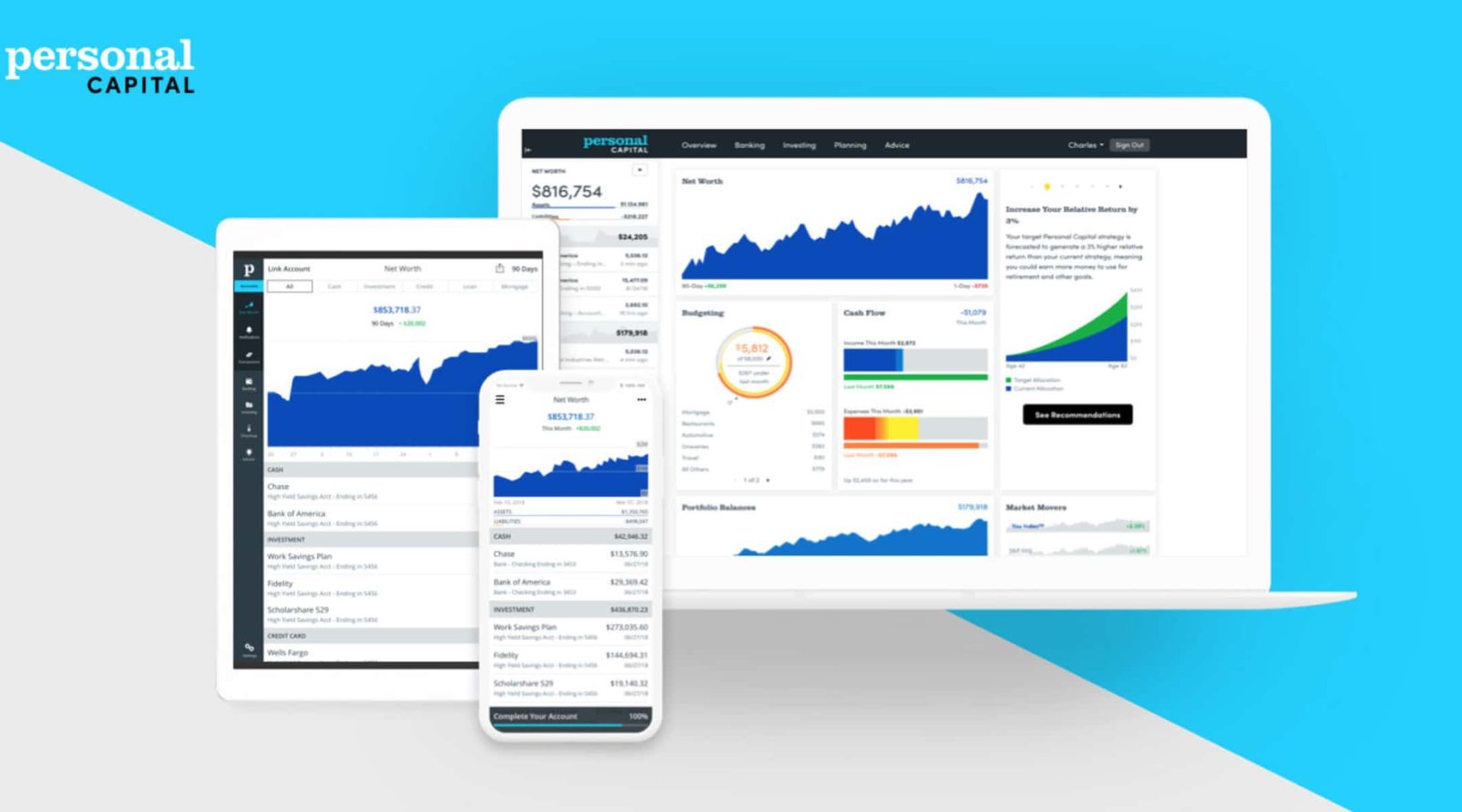

4. Personal Capital

Personal Capital is an all-encompassing financial budgeting app that offers budget planning tools along with investment tracking and retirement planning features. It syncs with your accounts to deliver a complete view of your financial life, including your net worth and investment presentation. Personal Capital’s budgeting tools help users track expenditure, view cash flow, and plan for long-term financial goals.

Expert Opinion:

Sarah Thompson, Wealth Manager

“Personal Capital is outstanding for those looking for a complete financial dashboard. Its capacity to integrate budgeting with investment management makes it a valuable tool for money building and retirement plans.”

5. Goodbudget

Goodbudget is focused on the cover budgeting method, where users assign money into simulated envelopes for different expenditure categories. This method helps users imagine and control their spending efficiently. Goodbudget is mostly useful for couples and families looking to coordinate their budgets and track shared expenditures collaboratively.

Expert Opinion:

Michael Brown, Financial Consultant

“Goodbudget is model for those who desire a hands-on approach to planning. Its cover system is a great way to assign funds and preserve discipline in expenses.”

Overall Opinion About Budgeting Apps

Selecting the best budgeting app depends on your financial plans, personal preferences, and level of comfort with budgeting methods. These budgeting apps offer a variety of features and methods to suit different requirements, from basic expense tracking to complete financial planning. Eventually, finding the right budgeting app can allow you to take control of your finances and work towards attaining your financial objectives successfully.